Debunking the Downpayment Myths: What You Actually Need to Buy a Home

For many aspiring homeowners, the downpayment is often viewed as the single greatest barrier to entry in the real estate market. However, much of what people believe about these upfront costs is rooted in outdated information and misconceptions.

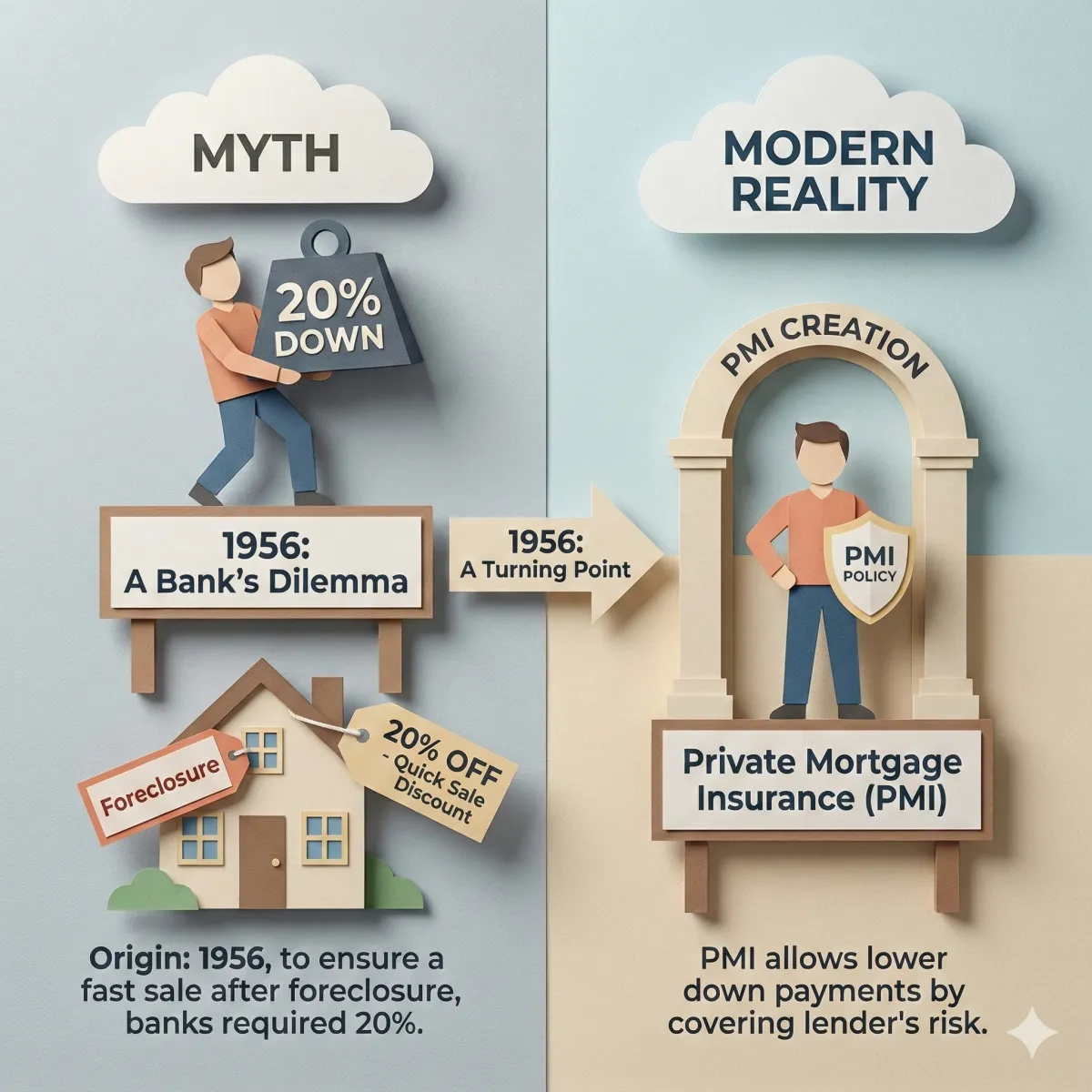

Myth 1: You Need a 20% Downpayment to Buy a Home

The Origin of the Myth: This "rule" originated around 1956 when real estate information did not flow as freely as it does today. If a bank had to foreclose on a home, they wanted to sell it as quickly as possible to get it off their books. To ensure a fast sale, they often sold properties at a 20% discount. Therefore, requiring a 20% downpayment acted as the bank’s insurance policy.

The Modern Reality: The landscape changed in 1956 with the birth of the Private Mortgage Insurance (PMI) industry. PMI allows banks to accept lower downpayments by providing an insurance policy that covers the lender's risk in the event of a default.

Myth 2: You Must Use Your Own Savings for the Entire Downpayment

Many buyers believe they have to spend years liquidating their savings to afford a home, but there are several ways to supplement your funds.

Gift Funds: Many loan types allow for the use of "gift funds" provided by family members to help cover the downpayment.

Assistance Programs: There are various downpayment assistance programs available to help bridge the gap for qualified buyers.

Seller Concessions: Depending on the loan type, you may be able to negotiate with the seller to pay for some of your closing costs.

Myth 3: The Purchase Price is the Most Important Number

While the top-line price of a home is important, it is often a "static" number that doesn't tell the whole story. Experts suggest that buyers should focus more on their monthly payment comfort level.

Your monthly reality is dictated by more than just the loan amount; it includes principal, interest, property taxes, homeowners insurance, and HOA fees. Because interest rates change daily, a shift in rates can significantly change your buying power even if the home price remains the same.

The Path to Confidence: Pre-Approval

The best way to cut through the myths and understand your specific situation is to obtain a pre-approval. Think of a pre-approval as a "financial background check"; it shows sellers that a lender has already verified your credit, income, and assets. This turns you from a "browser" into a buyer and ensures your offer is based on real data rather than guesses.